Ulbrich Economic Update - Number 40 (September 2023)

Get the Full September Issue:

Click here to download the 16 page Economic Update for the full details of recent economic trends impacting the steel and commodities markets, as well as the associated industries across the globe. Continue reading below for the Executive Summary.

September 2023 Economic Update Executive Summary

The Americas

THE U.S. ECONOMY ADDED 187,000 JOBS, but a 3.8% rise in the unemployment rate and moderation in wage growth fueled expectations the Fed could pause its rate hike cycle in September. Other August data showed: Manufacturing activity contracted for a 10th straight month (ISM), but the pace of decline continued to slow, suggesting that the sector could be stabilizing at lower levels. Consumer confidence fell after two straight monthly increases amid renewed concerns about inflation. July data showed: Manufacturing output increased 0.5%, bolstered by motor vehicle and parts output which accelerated 5.2%. Utilities production soared 5.4%. Durable goods orders fell by 5.2%, pulled lower by a 14.3% plunge in transportation orders.

The leading economic indicators index fell for the 16th straight monthly decline. The Conference Board forecasts a short and shallow recession in the 4th Qtr to the 1st Qtr of 2024. Meanwhile, Goldman Sachs lowered its estimated 12-month recession probability to 15%, down five percentage points from its prior forecast. The core consumer price index rose 0.2% for a second month, the smallest back-to-back gains in more than two years. Producer prices increased 0.3%, as the cost of wholesale services jumped 0.5%. A surge in portfolio management fees accounted for 40% of the rise in services. Retail sales recorded a robust 0.7% monthly surge. Consumer spending increased by 0.8%, the most in six months. Construction spending rose a solid 0.7% as a shortage of houses boosted outlays on single-family projects, which surged 2.8%.

Steel Industry Updates

FINLAND’S OUTOKUMPU NOTED A “SOLID” PERFORMANCE IN THE AMERICAS, where deliveries increased in the 2nd Qtr. The company is investigating options to expand operations in the U.S., including an increase of cold-rolling capacity and the construction of a new hot-rolling mill. U.S. Steel started a formal review process after rejecting a $7.25bn takeover offer from Cleveland-Cliffs as "unreasonable”. The Commerce Department set preliminary anti-dumping duties on tinplate from Canada, Germany and China. Food and steel can companies claim the only two domestic tinplate manufacturers, Cleveland-Cliffs and U.S. Steel, cannot meet demand.

Overseas

JAPAN’S GDP ROSE AT AN ANNUALIZED RATE OF 6% DURING THE APRIL-JUNE PERIOD, propelled by resurgent car exports. The weak yen, which remains close to multi-decade lows, has been a boon to exporters. China’s exports and imports fell more sharply than expected in July, adding to a prolonged trade slump fueling concerns about growth prospects for the world’s 2nd-largest economy. Exports declined 14.5% YOY in dollar terms. Manufacturing activity has contracted for 4 straight months.

Energy Sector News

THE U.S. DEPARTMENT OF ENERGY WILL SPEND $1.2BN FOR TWO PIONEERING FACILITIES—one in Texas, the other in Louisiana—that will remove millions of tons of carbon dioxide annually from the atmosphere using a technology known as direct air capture (DAC). The EU’s gas-storage levels are on the brink of hitting their pre-winter target more than two months early, a boost for the bloc’s economy. France will allow electricity producers to burn more coal this winter to prevent potential power shortages.

Medical Insights

ASTRAZENECA BECAME THE LATEST LARGE PHARMACEUTICAL COMPANY TO SUE THE U.S. over a law that allows the government to negotiate some drug prices for the first time. The CBO estimates the changes will produce savings worth billions of dollars over a decade. GE HealthCare received clearance for a device that enables hospitals to continuously monitor vital signs while allowing patients to move about the ward. The device combines wireless patient-worn sensors with a smartphone-style monitor.

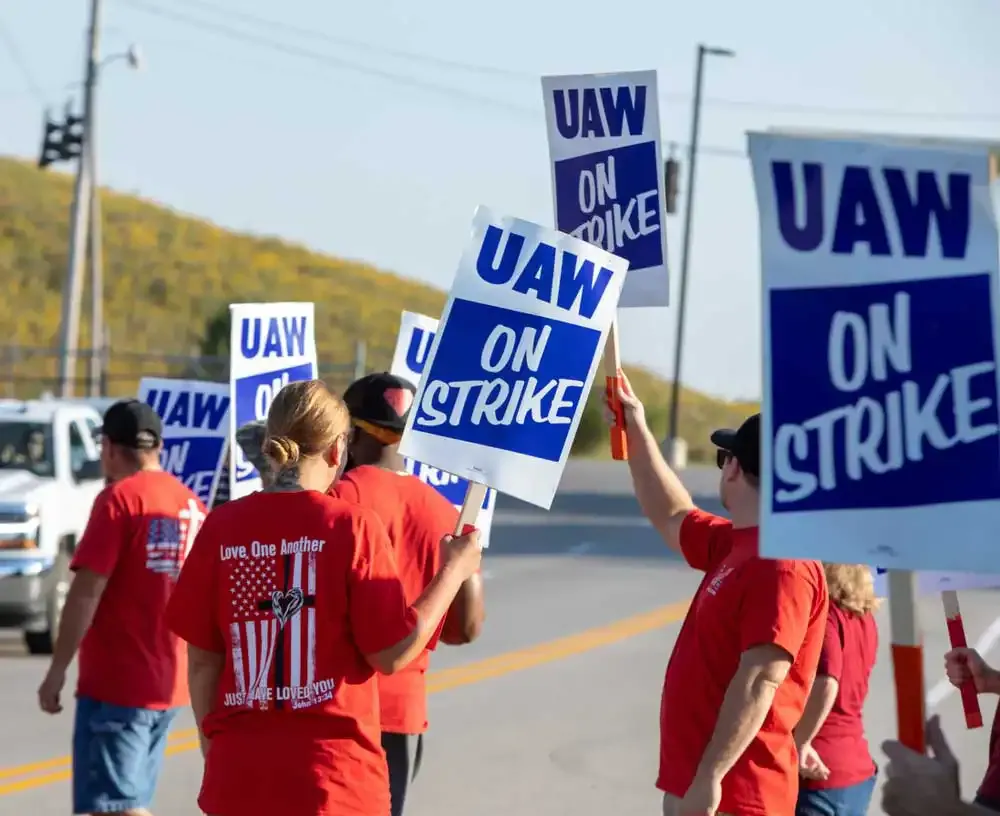

Automotive Trends

A STRIKE BY 143,000 UAW MEMBERS AGAINST FORD, GM AND STELLANTIS MIGHT COST $5BN in economic losses after 10 days. The estimate includes potential losses to UAW workers, the manufacturers and to the auto industry more broadly if negotiations are not successful before the current contract expires in mid-September. Ford Motor CEO Jim Farley is aiming to create a continuing revenue stream from software services that will smooth out the boom-and-bust cycles in the car business.

Metals & Commodities

UC RUSAL IS ENTERING INTO A CRITICAL POINT IN THE YEAR, as the traditional aluminum “mating season” occurs in September, when buyers and sellers negotiate contracts for the coming year. Although Rusal has no sanctions against it, many buyers have shunned the company due to Russia’s military operations in Ukraine. BHP, heavily reliant on Chinese construction demand for steel made from its iron ore, said underlying profits for its year to the end of June were down 37% from a year earlier.

Aerospace Developments

BALL CORP WILL SELL ITS AEROSPACE DIVISION TO U.K. DEFENSE CONTRACTOR BAE SYSTEMS for $5.6bn in cash. The aerospace unit of Ball, widely known for its beverage can business, deals in manufacturing spacecraft and specialized aerial systems. A Russian robotic spacecraft that was headed to the lunar surface crashed into the Moon. India, with the successful landing of the Chandrayaan-3 spacecraft, became the fourth country to land on the Moon and the first to land near the lunar South Pole.

Stay Up to Date:

Stay up to date on the latest state of the markets and ecosystems fueled by stainless steel and other key manufacturing materials by subscribing to get the Ulbrich Economic Update delivered to your inbox monthly. Subscribe to our newsletter.